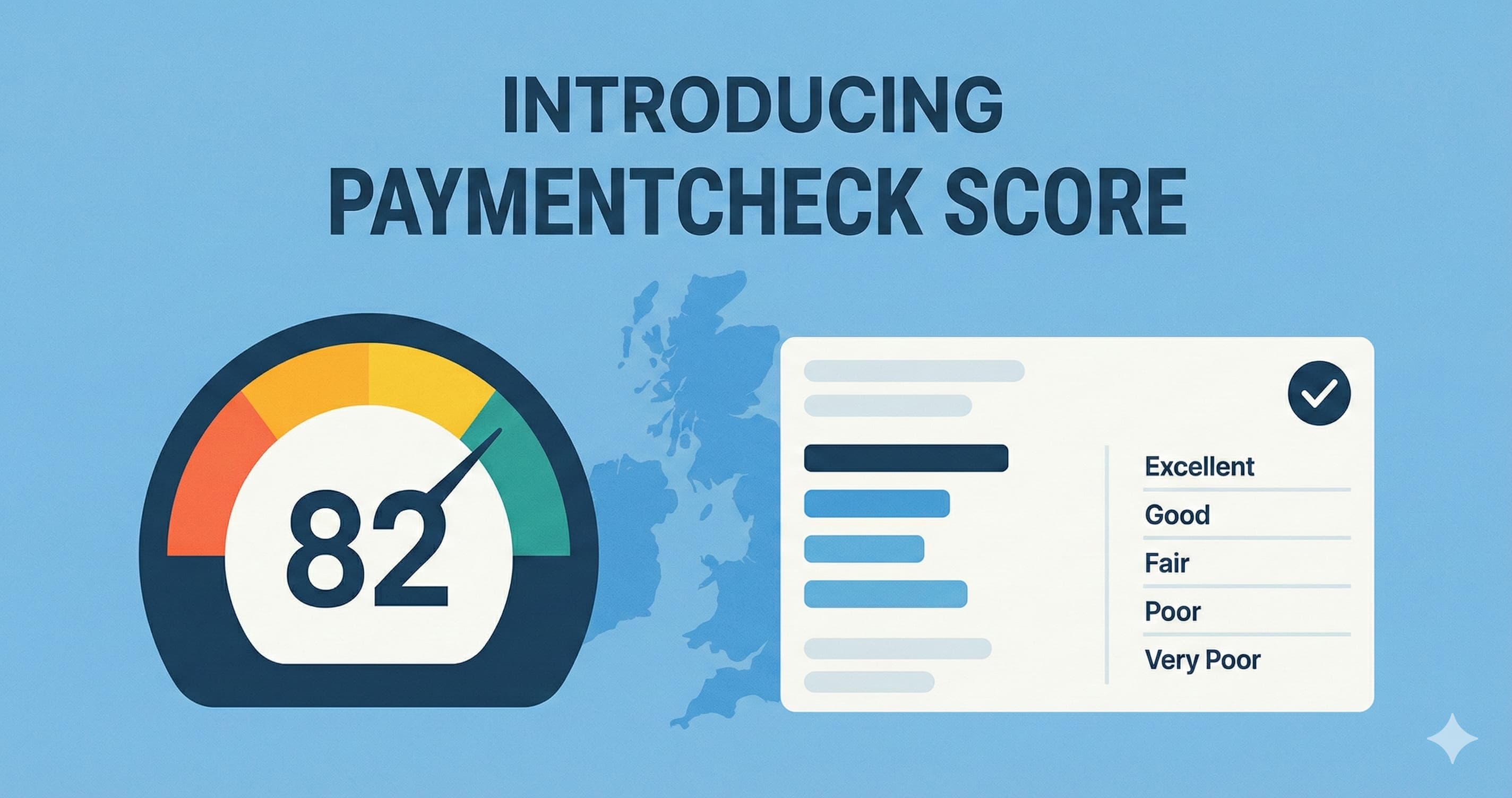

Introducing PaymentCheck Score: A New Way to Measure Payment Performance

We're thrilled to announce the launch of the PaymentCheck Score - a comprehensive rating system that makes it easier than ever to understand how well UK companies pay their suppliers.

What is the PaymentCheck Score?

The PaymentCheck Score is a rating from 0 to 100 that measures a company's payment performance based on official UK government data. Every company that reports their payment practices now receives an annual score, making it simple to compare payment behaviour across thousands of businesses.

You can see scores on any company profile - just search for a company to view their rating.

How We Calculate the Score

Our scoring algorithm analyses four key metrics from mandatory government reporting:

| Factor | Weight | What It Measures |

|---|---|---|

| Invoices paid within 30 days | 40% | Speed of payment |

| Average time to pay | 30% | Overall payment efficiency |

| Invoices not paid on time | 20% | Reliability |

| Invoices paid after 60 days | 10% | Late payment severity |

Fair Annual Comparisons

Companies report their payment practices every six months, but their reporting periods vary based on their fiscal year. A company might report for October-March, while another reports January-June.

To ensure fair annual comparisons, we use pro-rata weighting:

- If a 6-month report spans two calendar years, the score is proportionally attributed to each year based on months covered

- For example, a report covering October 2024 to March 2025 contributes 3 months to the 2024 score and 3 months to the 2025 score

- This means every company's annual score reflects the same 12-month measurement period, regardless of when their fiscal year ends

This approach ensures you're comparing like with like when evaluating payment performance across different companies.

Score Bands

Every company falls into one of five performance bands:

- Excellent (80-100) - Top-tier payers who consistently pay quickly

- Good (60-79) - Above-average payment performance

- Fair (40-59) - Average payment practices

- Poor (20-39) - Below-average, room for improvement

- Very Poor (0-19) - Significant payment concerns

Introducing PaymentCheck Awards

Alongside the scoring system, we're launching PaymentCheck Awards - an annual recognition of the UK's best payers.

What You'll Find

Explore our awards pages to discover:

- UK Top 100 - The hundred best-paying companies in Britain

- Most Improved - Companies showing the biggest year-on-year improvements

- New Entrants - Highest-scoring companies reporting for the first time

- Sector Champions - Top performers in industries like Construction, Retail, and Technology

- Regional Champions - Best payers in regions including London, Scotland, and the North West

Browse all sectors and regions to find leaderboards relevant to your industry or area.

Historical Data

We've calculated scores going back to 2020, so you can track how payment practices have evolved over time:

- 2025 Awards (Current year)

- 2024 Awards

- 2023 Awards

- 2022 Awards

- 2021 Awards

- 2020 Awards

Each company page now shows a score history chart, making it easy to spot trends over multiple years.

Why This Matters

Late payment remains a critical issue for UK businesses. According to recent data, small businesses are owed billions in overdue invoices, with many waiting months beyond agreed terms.

If you're owed money, our late payment calculator can help you work out exactly how much you're entitled to claim in statutory interest and compensation.

The PaymentCheck Score helps:

- Suppliers evaluate potential customers before agreeing credit terms

- Businesses benchmark their payment performance against competitors

- Industry bodies identify sectors with payment culture problems

- Policymakers track the effectiveness of payment legislation

See Your Score

Every company with payment practice data now has a PaymentCheck Score displayed on their profile page. Simply search for any company to see their current rating, historical scores, and where they rank nationally and within their sector.

Want to compare companies in your industry? Visit our sector pages or regional breakdowns to explore payment performance across the UK.

Recognising Excellence

Companies that achieve Excellent ratings deserve recognition. We believe that celebrating good payment behaviour encourages others to follow suit and helps create a fairer business environment for everyone.

View the 2025 UK Top 100 to see this year's best payers, or check out the Most Improved list to see which companies have made the biggest strides.

If your company has achieved a top score, we'd love to hear from you. Get in touch to discuss featuring your success story.